The aviation sector has been significantly impacted by the Covid-19 epidemic. Air travel demand and capacity fell drastically due to lockdowns, travel restrictions, and virus fear. Nonetheless, despite these difficulties, the sector is displaying promising signs of a significant rebound.

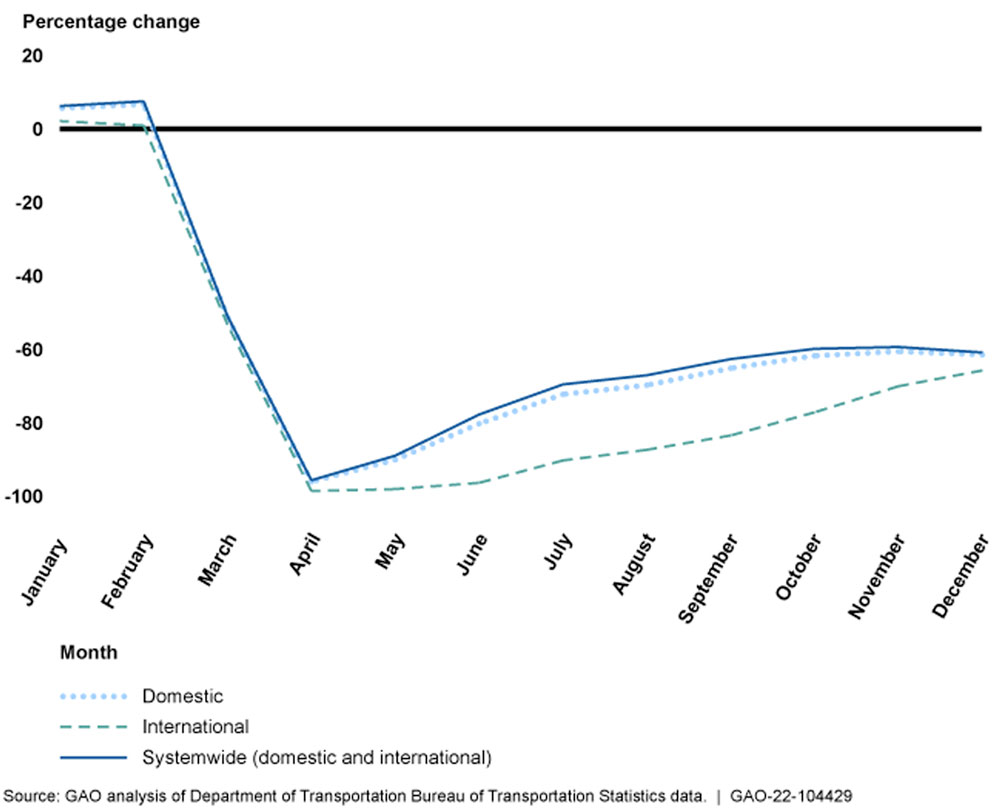

Demand for air travel fell to previously unheard-of levels during the pandemic. According to IATA, 2020 was the “worst year in history for air travel demand”. International passenger traffic fell by 75.6% in 2020 compared to 2019, capacity fell by 68.1%, and load factor dropped by 19.2%. As expected, this had a big effect on airports and airlines all over the world. When many airlines were forced to stop aircraft and lay off personnel, airport revenues suffered significantly.

U.S. Airline Passenger Traffic, Percentage Change 2019 versus 2020

Examples of airlines and airports that were hit hard by the pandemic include British Airways, which announced 12,000 job cuts in April 2020, and Frankfurt Airport, which saw a 70% decrease in passenger traffic in 2020.

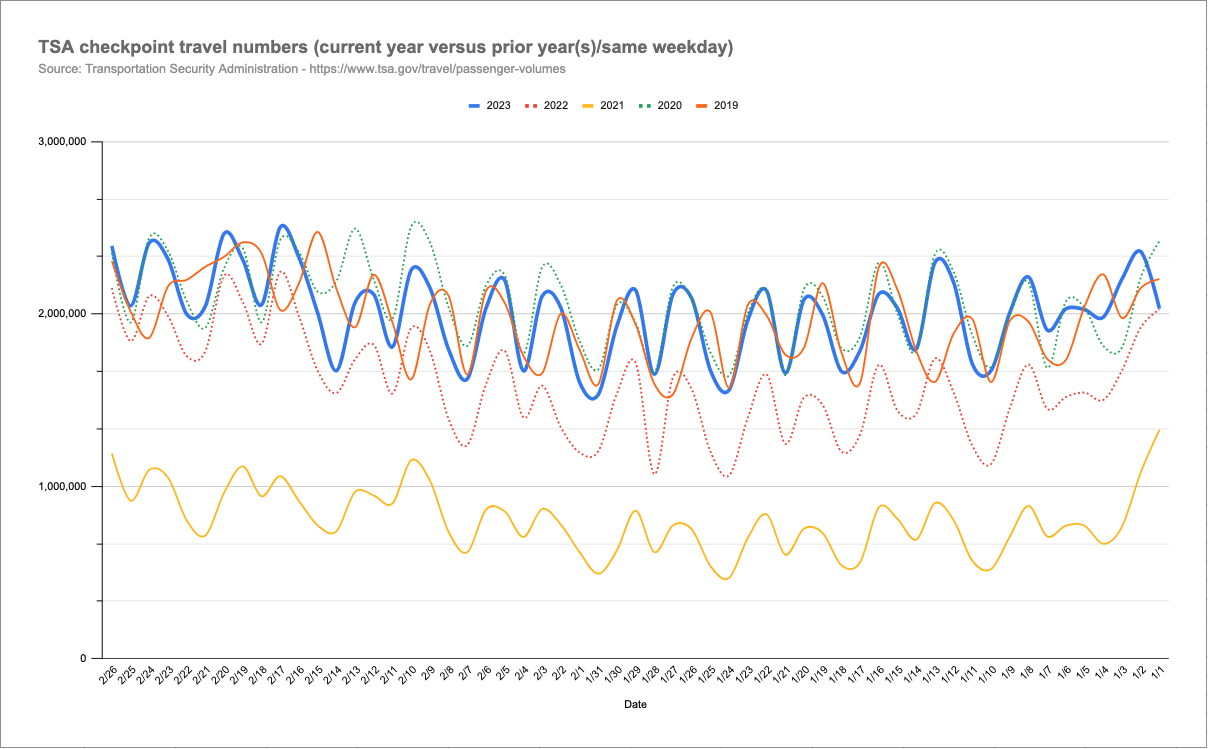

However, over the course of the past year, there have been signs of a resurgence in air travel. Bookings and passenger numbers have been steadily increasing, and airlines and airports are beginning to recover. For example, in the United States, the Transport Security Administration reports that passengers screened through their security checkpoints for the first 57 days of 2023 are already equalling and surpassing pre-pandemic levels.

There are several factors driving the resurgence in air travel. One was the rollout of vaccines, which has increased confidence among travelers. According to an article published by Reuters, vaccines helped the air industry recover after the COVID-19 pandemic by boosting consumer confidence about traveling. As more people got vaccinated, airlines witnessed a rebound in summer bookings, which led to a slowdown in cash burn for carriers like American Airlines and Southwest Airlines.

Due to the detrimental effects of the pandemic, the majority of U.S. airlines started disclosing a metric called “cash burn” in 2020 as a means of gauging their liquidity. Southwest forecasted a 2021 second-quarter average daily core cash burn between $2 million and $4 million, which was a significant improvement compared to the previous quarter (up to $13 million per day), and American Airlines reported an average daily cash burn of $4 million in March 2021, as per the same article.

Additionally, there is pent-up demand for travel, as many people were unable to travel during the pandemic. Furthermore, some countries have eased travel restrictions, which has allowed for more international travel.

International Airlines Group (IAG), the owner of airlines like British Airways, Iberia, Vueling, and others, has recently announced “a significantly profitable third quarter” in which it returned to the black in 2022, with a net profit of €431 million, which is a significant improvement compared to a net loss of €2.933 billion in 2021. The group sees this as a promising sign of recovery, and they anticipate even better results in 2023, as the reopening of key markets in Asia and China will enable British Airways to expand its operations. IAG is optimistic about achieving a solid profit in 2023 as it continues to transform its business.

Despite the promising indicators, the air transport industry still faces challenges in the wake of the Covid-19 pandemic. While there have been some positive signs of recovery, such as increasing passenger numbers and easing travel restrictions, the industry still faces numerous challenges. The air transport industry must continue to navigate these challenges and adapt to the changing landscape in order to emerge stronger in the post-pandemic era. Although the pandemic’s long-term effects on the sector are still unknown, the aviation sector is positioned to rebound more powerfully than ever with ongoing innovation and adaptation.