Industry Performance

Air transport in Latin America and the Caribbean (LAC) supports 7.6 million jobs and $187 billion in economic activity, as per latest estimates by Air Transport Action Group (ATAG). This means that 2.7% of all employment and 3.5% of all gross domestic product (GDP) in LAC countries are derived from the air transport industry. Airlines, airport operators, retailers and other on-site businesses, as well as air navigation services, and civil aircraft manufacturers, all contribute to GDP in Latin America and the Caribbean. In 2018 (latest data available), the operations of these businesses generated a $49 billion direct contribution to GDP.

$187 B

Contribution to Latin America and the Caribbean's GDP

305.1 M

Passengers Carried (2019)

6.3 M Ton-KM

Freight Handled (2019)

4.7%

(Annual Growth Rate for Air Traffic in LAC, '14-'34)

Air Freight and Passenger Volume

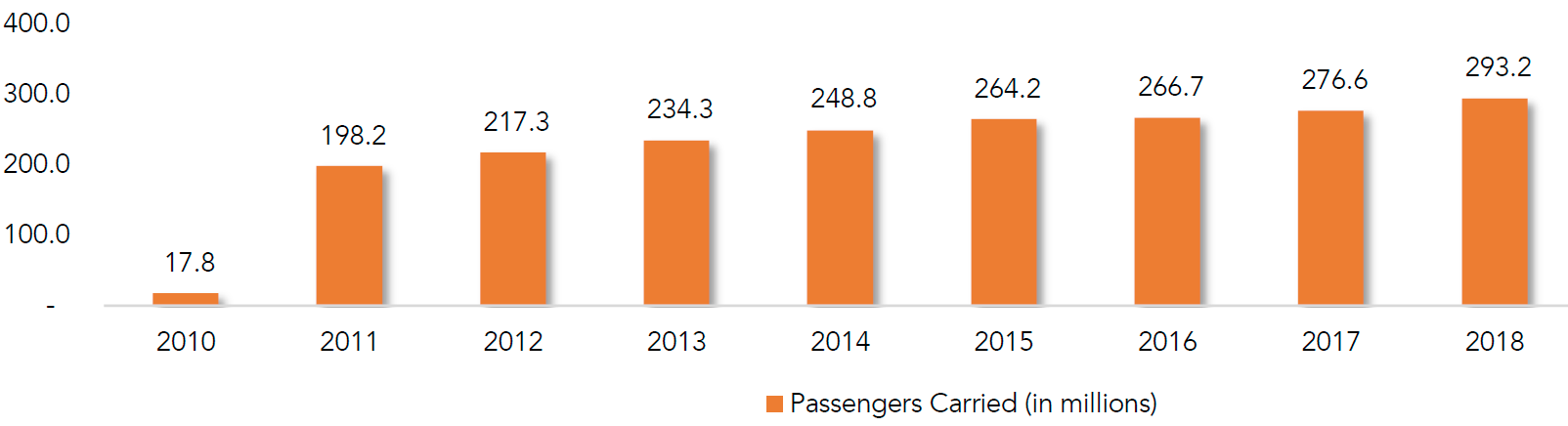

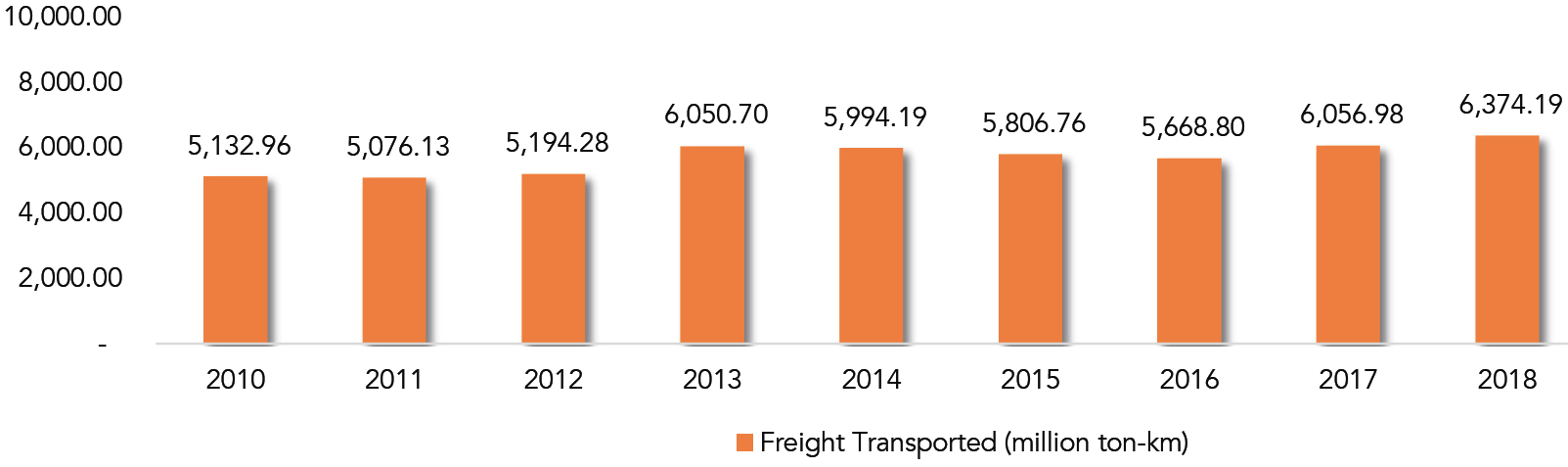

According to World Bank data, passengers transported in LAC reached approximately 305.1 million pre-pandemic. This represents the highest volume of passengers in the region recorded in the past decade. Also in 2019, an estimated 6.3 million metric tons of air freight were handled in the region. The COVID-19 pandemic has had a devastating effect on the air transport industry as much of the LAC effectively shut down during the height of the crisis, with some countries’ travel restrictions stricter and in place much longer than in other parts of the world.

Nevertheless, recovery is underway. The International Air Transport Association (IATA) reports that the region’s airports have seen a gradual but sustained recovery since June 2021, reaching 45% of the total number of passengers carried in November 2019.

IATA also estimates that the market should recover by 2023, with traffic in LAC reaching 2019 levels again late in 2023 or early 2024. Importantly, the trade association projects that the region will experience a 2.9% growth in passenger journey in the next two decades, or adding about 288 million passengers over the years to 2040.

Passengers Carried in Latin America and the Caribbean (World Bank, 2022)

Freight Transported in Latin America and the Caribbean (World Bank, 2022)

LAC’s Infrastructure Gap

The Latin America and the Caribbean region has an infrastructure gap. The Inter-Development Bank (IDB) states that the region suffers from insufficient annual investment to close this deficiency. In terms of investment effort relative to the size of the economy, LAC will need to invest at least 3.12% of its GDP in infrastructure each year until 2030.

In discussions about saving behavior, a common critique is that the region saves little. Data from IMF World Economic Outlook supports this statement – in terms of GDP, the region saves 10% to 15% less than the most dynamic countries of emerging Asia. Low national saving limits the financing available for building and maintaining productive infrastructure such as airports, and further results in inadequate economic contributions.

Airport Service Quality

Airports face several challenges when serving passengers, for instance, as a result of terminal congestion, uneven demand, exposure to local disruptions and external events, the involvement of multiple staff and service providers, and fragmented passenger segments that have diverse expectations regarding service quality. Based on Airport Council International (ACI) and the International Air Transport Association (IATA) reviews, passengers at Latin American and Caribbean airports are likely to be passive promoters of airports. This means that they are satisfied with the airport, and while many of them may recommend the airport, they are generally less enthusiastic than active promoters are. Furthermore, they are more vulnerable to competitive offerings. The results show that when a passenger has experienced failure with any of the service attributes – queueing times, terminal cleanliness, terminal seating, terminal signs and directions, food and beverages, airport shipping, airport wifi service, and airport staff – the probability to actively promote an airport relatively decreases.

Airports are fixed assets and some of them operate in less competitive markets than others, which means that in some cases, consumers have limited alternative options to choose from when traveling. The study notes that there is always a risk that such airports might abuse their market power by paying little attention to service quality, which in turn impacts the likelihood of consumers appreciating and promoting an airport. Service quality has therefore become a key area of interest to airports and other stakeholders, and many airports have either come up with their own airport service quality monitoring program or have turned to public and private partnerships.

Demand for Public-Private Partnerships (PPPs) in LAC

In a combined effort to reduce infrastructure gaps and improve airport service, PPPs have become a popular tool since the early 1990s. LAC was the predominant region for PPPs until the late 1990s, when investments plummeted due in part to a backlash of poorly-implemented PPPs. Their potential usefulness is clear: PPPs can help overcome some of the limitations of public provision – inefficiencies, lack of technical skills, slow procurement processes, and budget constraints. Thanks to PPP mechanisms, quality, efficiency, and competitiveness of airports in LAC can be increased. Airports Council International says that the airport business, traditionally operated by state companies with low efficiency levels, is intensive in the use of capital and may require many years to recover significant investments in terminals and runways.

Why PPPs Are Needed

On the one hand, using PPPs supplements the financing from the public sector and allows the development of projects that would otherwise be dismissed due to fiscal restrictions.

It also has the potential of obtaining better operational results when creating incentives that align with public and private interests, where the private sector operates the infrastructure and generates revenue derived from said operation for the state.

According to IDB, growth projections of the air transport industry, together with capacity and service restrictions, impact the need of development of the sector in the region. Air transport has a 4.7% average annual growth projection for the next 10 years in the region. This implies that the airports in the region will need to invest around $146 billion in the air transport industry to develop new infrastructure and maintain the existing airport infrastructure until 2040; twice the amount is needed, for example, in Europe for the same period.

The impressive growth forecast of the air transport market in LAC is not only the result of the region’s economic development, but also due to the existence of higher levels of investment, and larger access to new service operators and providers. All this is bringing additional pressure on airport infrastructure in the region. Governments are responding by increasing efforts to extend and update airports, essentially by collaborating with the private sector, which bodes well for NewCo.

Contract Types

Most countries in LAC with a significant volume of passengers have PPP airports: Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Honduras, Jamaica, Mexico, Peru, and Uruguay. From 1993 to 2019 (with the exception of 1997 and 2005), every year at least one airport PPP started in the region. There are 168 airports in the region operating under a PPP scheme as early as 2019, with 90% conducted on completely-or-partially-existing infrastructure (brownfield projects), compared to 10% development of new airport infrastructure (greenfield projects). Most concessions include all the operations in the terminal, runway, and other regulated and non-regulated (commercial) services, and exclude air traffic control.

Contract Duration

Most contracts last between 16 and 30 years. The table below shows the average duration of contracts per country. The term is fixed in most cases, except for Bogotá and the first concession in Santiago (which lasted 17 years). In those cases, the contract ends when the operator reaches certain total revenue. Mostly, the minimum duration is 20 years, while the maximum length ranges from 25 to 30 years.

Additional PPP Trends

- Regarding the characteristics of the tender, 81% of LAC airports observed by Inter- Development Bank (IDB) used a one-stage public tender (i.e. the operator is chosen and granted the rights over the contract in a single process), and the standard business structure is a privately-owned company with a specific purpose.

- In an airport PPP tender process in LAC, receiving offers from three bidders is the most frequent situation (26% of cases). In most of cases, the number is below five (89% of all PPs). This matches the high degree of concentration in the industry.

- With regards to the tender factors, experience in the region shows that a higher payment to the government was applied in half the PPPs, being the most common practice in Brazil, Colombia, and Mexico, among others. Overall, there are six tender factors frequently used in the region: higher payment to the government, lower subsidies, lower tariffs, lower revenue for the operator, shorter contract duration, and larger investments.

- Most PPPs in LAC are self-sustainable and generate revenue from aviation activities (such as the use of the passenger terminal, landing of aircrafts, etc.), and commercial (including non-aviation activities, such as parking, retail business, etc.). According to the International Civil Aviation Organization (ICAO), revenue from commercial activities accounted for 38% of total airport revenue in the world and 36% in LAC.

- Airport PPPs predetermine investment requirements, with a wide range between $10 million to $200 million. The predetermined investment amount requirement is a prevailing feature in airport PPPs in the region. The most frequently made investment is between $10 million and $200 million, with an average above $1 billion strongly conditioned by wide investments required by greenfield airports studied by IDB.

- It is also frequent for contracts to include the obligation of making investments during the life of the partnership to ensure certain levels of maintenance of the infrastructure and provision of adequate services.